How Can China’s Pharmaceutical Industry Emerge From Its Darkest Hour?

On 22 April 2022, a Friday evening, Hengrui, the "number one pharmaceutical company", officially released its annual report, covering the company's first negative growth in the past two decades. As a former leader in China's pharmaceutical industry, Hengrui's difficult transition is more of a painful exploration of the pharmaceutical industry in the process of breaking down the old and creating a new one.

Behind the dismal revenue and net profit figures, there is a short to medium term trend in both sectors: the traditional business has basically come to a standstill due to the price squeeze on the whole area. As for the innovation business, the revenue side is growing at a slower rate than expected against the backdrop of medical insurance cost control, but instead the expense side is increasing due to rising costs and increasing clinical demand in the context of going abroad.

So Hengrui's figures for the past year are very realistic: revenue fell by 6.59%, while net profit fell by 28.41%, and this was after capitalising nearly 260 million in R&D expenditure in the fourth quarter of last year - even with a slight whitewash, it was hard to hide the huge decline in performance.

This result has also fed through to the capital markets in advance, with the market capitalisation continuing to hit new lows in the last five years since the start of this year at a near "waistline" even after a full year of declines in the past.

Hengrui is not representative of the entire pharmaceutical industry, but it is an extremely pure pharmaceutical company - it does not chase hot topics and has no other redundant businesses; it has few capital operations and all of the company's expenses come from the company's operating cash flow.

Therefore, the fall of Hengrui, the "king of pharmaceuticals", is more a result of the fact that the overall pharmaceutical industry in China, at a time when the traditional generic business has not yet been cleared out and the innovative business has not yet reached true maturity, has come up against a highly volatile macroeconomic environment, which has combined to form a "dark moment" for the industry. The "darkest hour" of the industry.

China's pharmaceutical industry is a policy-oriented industry, and before the pharmaceutical supply-side reform in 2015, the pharmaceutical industry was almost entirely "bad news", with national "negative policies" being introduced at regular intervals during the years of drug price siege.

During the years of the drug price round-up, there were national "negative policies" introduced at regular intervals. There were times when the macro environment was bad, but the industry, at every dark moment, came through one step at a time.

The ups and downs of the secondary market

The secondary market is still essentially a "financing-dividend" channel, but before the rise of innovative drugs, the Chinese pharmaceutical industry, which started with nothing, did not have much experience of "significant leverage expansion". Therefore, unlike the internet, the pharmaceutical industry is not as rich as the internet, which can be thousands of times richer.

But the market value of the company is still related to the wealth of the executives of these listed companies, after all, on paper, everyone will look at the wealth. After the acceleration of the capital linkage in the past two years, the pharmaceutical industry has been increasingly valued by all kinds of funds, and innovative drugs itself is a field that requires long-term irrigation of funds, so some movements in the secondary market are also increasingly affecting the hearts and minds of the entire industry.

However, apart from the quality of the companies themselves, their valuation is also more related to monetary policy and macroeconomic factors. The movement of various broad market indices, such as the Shanghai Stock Exchange, Shenzhen Stock Exchange and CSI 300, is to a certain extent a barometer of the macro environment.

In the past two decades, China's A-share market has experienced several so-called "epic crashes", which, when viewed outside the historical dimension, have actually followed a similar process: "long-brewing concerns" → "sudden blow " → "stampede exodus in panic" → "policy attempts to intervene in the market to no avail" → "all news interpreted as negative" → "Large number of players leave the market" → "Gradual recovery".

In 2008, China's economy took a sharp turn for the worse as global monetary liquidity tightened as a result of the US sub-prime mortgage crisis. As early as the previous year, the market hung at an all-time high because of a series of favourable policies stimulated out.

As soon as the financial tsunami gained momentum in 2008, the stock market started to fall off a cliff, with the Shanghai Stock Exchange Index falling to a low of 1664 points, and it was only after the policy tools such as lowering stamp duty, lowering quotas and expanding the table were finally exhausted that the market slowly appeared to stop falling.

2012 was also a year of stock market crashes. This was because the policy encouragement-type tools of 2008 were all pulled out at once, greatly stimulating the rate of expansion of listed companies.

By 2010, the capital expenditure of listed companies had already reached its highest value and the growth trend had already started to emerge. It was not until 2012 that the rhetoric of "GDP protection 8" started to come to the forefront and the expectation of economic downturn spread throughout the society, directly leading to a liquidity crunch throughout 2012. The daily turnover was only a few tens of billions, and the issuance of new shares was almost halted.

In 2015, the ups and downs of the A-share market had little to do with economic fundamentals and was more of a "stock madness" caused by the lack of regulation and the entry of a large amount of leveraged funds. On the contrary, in 2018, under the background of the Sino-US trade war, Trump's frequent tariff increases have caused a matrix of domestic export-oriented industrial chains and everyone is worried about the trend of globalisation decoupling.

Under pessimistic expectations, the "ghost stories" represented by declining social financing and deleveraging continued to play out, further pushing up market fears. Once again, it was a year that is hard to erase from the memories of A-share shareholders.

This time, it was the same story: the lack of new growth support against the backdrop of real estate deleveraging, the start of a fall in the sharp increase in exports brought about by the well-controlled epidemic last year, and global liquidity concerns caused by interest rate hikes and tapering across the ocean, all combined to create an extremely pessimistic macro environment. Finally, it met with a localised domestic outbreak ......

In fact, the concerns about the macro environment during the past few A-share selloffs have not ended up happening. Historical experience shows that as long as the subject does not change essentially, the macro economy will always be an oscillating reciprocal, upward spiral a process.

And although the pharmaceutical industry, because of its strong immediate needs and livelihood attributes, is much less affected by the macro environment than other industries, it is still within the system and is more or less affected by the overall context.

In the past two years, in the context of the reform of the payment side has just been put on the agenda, the whole industry has put forward a comprehensive demand for quality and efficiency, but in a macro environment under a short-term pessimistic expectation, so the capital market around pharmaceutical projects, both secondary and primary, began to face the so-called "cold winter".

But winter in the season is measured in quarters; the longest "winter" in the market, historically speaking, has not exceeded three years.

A dark time for the pharmaceutical industry

Although most of the time the rights and wrongs of the secondary market do not affect the foundations of a (profitable and mature) company, this industry, with its strong policy attributes, has experienced its own industry downturn, and there are few of them.

In 2018, at an industry forum called "Change & Transformation", after the moderator and guests had spoken eloquently for a long time, it was time for a question session, and a marketing officer from a domestic company on stage asked a very helpless question: "You have talked a lot about the technical details of the transformation after the collection today, but there is One problem is that our products are not eligible to participate in pooling this year, and this team will probably be removed soon, so how are we going to survive?"

In a sense, pooling is a way of "smoothing out capillaries" to control drug prices. At the beginning of the launch, for companies outside a variety of winning bids, the market goes straight to zero, which for some companies and teams is equivalent to a direct declaration of death, and there is no room for them once they land.

This was the consensus of most people when the pooling was first launched in 2018. But over the years, those involved in the collection of pharmaceutical companies, not to say that all went into bankruptcy and liquidation, once shortlisted and lost the bid of Jingxin, well-known large single product companies but lost the bid of Xinlitai, and although all won the bid but basically the floor price of Huahai, these companies in the past two years transformation of transformation, adaptation to adapt, basically out of the shadow of the collection of mining.

Even a certain distributor company that asked a question at the forum about how to survive, later found other varieties in time to be an agent, and the company is still running normally.

Every three years is a big policy year for the pharmaceutical industry.

In 2009, when the basic drug system was implemented, the "lowest bid" model, initiated in Anhui Province, was gradually expanded to the whole country. At that time, only one evaluation factor was considered in the bidding for the basic drug catalogue, namely price, which led to a large number of ultra-low price bids.

At that time, some entrepreneurs predicted that once the Anhui model was implemented, more than a few hundred pharmaceutical companies would die. This one-size-fits-all system will also lead to a number of deviations: Sichuan Shuzhong pharmaceutical "apple peel instead of plate blue root", but also let the industry aware of the impact of low prices on the quality of drugs.

But although the "Anhui model" had a high profile when it debuted, once attracting people from Beijing to come and study the experience, it was not implemented nationwide after all.

In 2015, although it seems to be a crucial year for breaking the old and establishing the new, when the 7-22 storm (July 22, 2015, the State Food and Drug Administration (CFDA) issued the "Notice on the Self-checking and Verification of Drug Clinical Trial Data") landed, countless pharmaceutical companies were faced with a life and death decision: whether to recall the clinical trials they had already spent huge amounts of money on, or to risk being dragged into the blackmail of the drug regulator.

The decision was whether to recall clinical trials for which huge sums of money had been spent, or to risk being blacklisted by the drug regulator?

This is also a dark moment for pharmaceutical companies with a small product range and a single structure. But in the long run, should we take 7-22 seven years ago or not? At least now, the answer seems to be yes.

In fact, every "negative policy" in the pharmaceutical industry is a sieve, sifting out those companies that can't handle the changes or are contrary to the top-level design. Of course, some players who do not follow the rules of the game will be sifted out, and then the policy will be relaxed and a series of stimulus measures will be implemented to fill the sieve with more companies, which will then be nurtured for a period of time and the sifting process will be started again.

In the end, there will be a group of pharmaceutical companies that are invincible, that can compete with foreign investors, that have successfully gone abroad and that can truly represent the Chinese pharmaceutical industry.

What kind of companies will history choose from the future?

Pharmaceuticals is still a sector that requires long-term attention, but the decline in the A-share pharmaceutical sector over the past few days has made it almost impossible to ignore a few key facts.

Firstly, the growth rate of the pharmaceutical industry is required to be higher than the total GDP in the 14th Five-Year Plan, behind which is the fact that the resources of the whole society will continue to be tilted towards the pharmaceutical industry, after all, the aging process is getting faster and the country needs better medical conditions to face.

Secondly, even though the growth rate of both innovative drugs and generic drugs has declined this year, the primary industry still has a certain degree of enthusiasm, and there is still no downward trend in the orders in hand of CRO companies, and there are still a large number of players playing the game of bio-innovative drugs, and where there are people, there is always a market.

Finally, since the second half of last year, some binding policies have apparently started to be loosened: drug collection has started to consider the inclusion of more winning bidders, approval has been accelerated and continues to be carried out, price reductions in health insurance negotiations are not as large as before, and space for commercialisation of health insurance is being explored.

When the industry is overwhelmed by too many restrictive policies, various relaxation actions will be launched one after another, and the feedback from the industry is often with some "lag", and it is often difficult to realize this change in the early stage. By the time the policy is fully clarified, it may be time to start restraining again.

It's a process of de-bunking.

What companies can do in this process is to maintain their strength; to have a forward-looking vision, at least to see clearly the development direction of China's pharmaceutical industry for five to ten years; and to have strong execution and rapid adaptability to be able to stand out in the next upward cycle ahead of their peers.

As for how to survive this "hard time", it is actually very simple to put down your mobile phone, put down your anxiety and calmly do every little thing in your daily life. No news is the best news.

Don't forget to share this post!

Blister Packaging Machine Related Posts

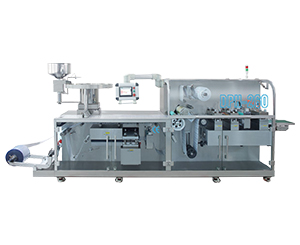

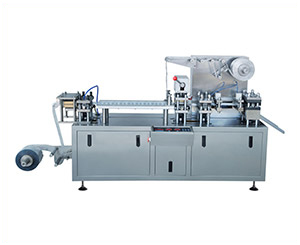

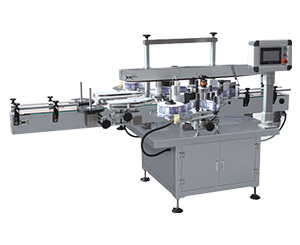

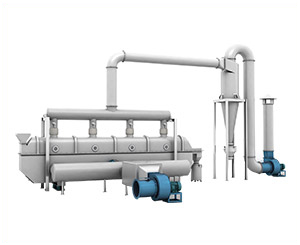

Blister Packaging Machine Related Products

Blister Packaging Machine Related Videos

CONTACT US

Tell us your raw material and project budget to get quotations within 24 hours.

WhatsApp Us: +86 189 7157 0951

Want the best price & newest pharmaceutical machinery buying guide,tips and trends sent straightly to your box?Sign up for Aipak’s monthly newsletter,we’re free for your consultation and Offer you the most suitable solutions!

The Buyer's Guide

- Capsule Filling Buyer's Guide

- Blister Packaging Buyer's Guide

- Tablet Counting Buyer's Guide

- Tube Filling Buyer's Guide

- Cartoning Buyer's Guide

- Gummy Making Buyer's Guide

- CO2 Extraction Buyer's Guide

- Empty Capsules Buyer's Guide

- Suppository Filling Buyer's Guide

- Tablet Coating Buyer's Guide

- Tablet Press Buyer's Guide

- Softgel Encapsulation Buyer's Guide

Most Popular

- 7 Importance Of Pharmaceutical Packaging In Different Applications You Must Know

- 6 Advantages You Must Know About Tablet Counting Machine

- 8 Advantages of Blister Packaging You Must Know

- 6 Critical Applications of Automatic Capsule Filling Machine

- 6 Stations You must Know to Improve the Filling Quality of Automatic Capsule Filling Machine